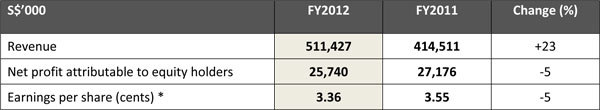

26 February 2013 Tiong Seng posts net profit of S$25.7 million on strong construction revenue

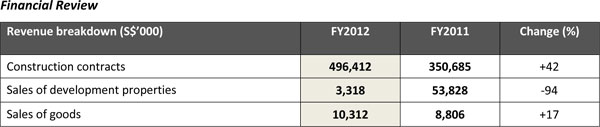

Mainboard-listed construction group and property developer, Tiong Seng Holdings Limited (長成控股) ("Tiong Seng", together with its subsidiaries, "the Group"), today announced a 23% year-on-year (yoy) rise in revenue to S$511.4 million for the full year ended 31 December 2012 (FY2012). The increase in revenue was largely attributable to higher revenue from construction contracts, which was partially offset by a decline in revenue from sales of development properties. Net profit attributable to equity holders (net profit) declined slightly by 5% yoy to S$25.7 million as the higher profit from the Group's construction projects was offset by the decline in other income and share of profit from joint venture projects. Adjusting for other income in FY2011 and FY2012, the Group's normalized net profit attributable to equity holders would have been $17.9 million in FY2011 versus S$22.2 million in FY2012. The board of directors is proposing a first and final dividend of 1.0 cent per share.

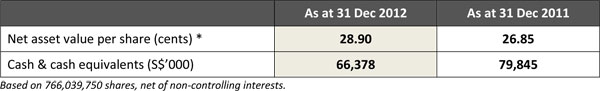

Revenue from construction contracts, the Group's largest revenue contributor, jumped 42% yoy to S$496.4 million.This was the result of an increase in work done for on-going projects, namely Hotel at Upper Pickering Street, Tree House, NUS Staff Housing at Kent Vale, Waterway Terraces I and II, Hundred Trees and The Glyndebourne.The increase was offset by a decrease in work done following the completion of The Wharf Residences, Volari, Hilltops and Shelford Suites.In accordance to the Group's revenue recognition policy, approximately S$22.8 million of work done for newly commenced projects in Singapore has yet to be recognised in FY2012. On the development properties front, revenue from sales of property development in FY2012 was contributed from sale of 1 unit totaling 84 sqm in Wenchang Broadway in Yangzhou and 4 units totaling 681 sqm in Tianmen Jinwan Building in Tianjin. This was in comparison to sales and recognition of 9 units totaling 2,154 sqm in Tianmen Jinwan Building in Tianjin and 440 units totaling 50,293 sqm in phase 1 of Sunny International project in Cangzhou in FY2011. As at 31 December 2012, remaining 1 unit, totaling 141 sqm of Tianmen Jinwan Building, 275 units, totaling 32,507 sqm of Sunny International Project and 4 units, totaling 239 sqm of Wenchang Broadway in Yangzhou were fully sold, but yet to be recognised as revenue in accordance to our revenue recognition policy. Revenue from the sales of goods rose 17% to S$10.3 million mainly attributable to an increase in sales volume of the Group's Cobiax product line as Cobiax increasingly gained recognition and acceptance by the market. As at 31 December 2012, Tiong Seng's cash and cash equivalents stood at S$66.4 million. In particular, the Group's operating activities gave rise to a net cash inflow of approximately S$19.3 million, which was The Group achieved earnings per share of 3.36 Singapore cents (based on the share capital of 766,039,750 shares and net of non-controlling interests) and net asset value per share of 28.90 Singapore cents.

Operational Review FY2012 was a challenging year as the construction sector contended with a poor global economic outlook, as well as rising competition and labour costs within Singapore. Nonetheless, Tiong Seng's order book remained strong at approximately S$1.3 billion, of which S$542 million were new orders secured during the year. The majority of the Group's order book is expected to be fulfilled over the next 12 to 30 months. The new construction orders secured during the year include the following:

On the property development front, as at 31 December 2012, the Group has completed the construction of Phase 1 out of 4 Phases, of the Sunny International Project (沧州阳光国际) in Cangzhou. All units of Phase 1 have been sold. Sales have been launched for Phase 2 and Phase 4 of the project and more than 80% of units in Phase 2 and Phase 4 have been sold as at 31 December 2012. The construction for Phase 2 and Phase 4 is expected to complete towards end of 4Q 2013. Also, the Group is currently carrying out construction for Phase 1, Phase 2 and Phase 3 out of 7 Phases for the Equinox project. The construction for Phase 1 and Phase 2 is expected to be completed towards 1Q2014 and construction for Phase 3 is expected to complete towards 4Q2014. Sales for Phase 1 and Phase 2 have commenced in 4Q2011 and 4Q2012 respectively. As at 31 December 2012, approximately 24% of the total 205 units of Phase 1 and Phase 2 have been sold. As well, the site-plan of residential project in Suzhou New District Xushuguan Development Zone has been approved by local authority and the construction is expected to commence in 1Q2013.

Outlook Construction In line with the White Paper's forecasts, the Building Construction Authority ("BCA") expects construction demand to range between S$26 billion and S$32 billion for 2013, anchored by public sector projects amounting to S$14 to $17 billion. For 2014 and 2015, demand is projected to range between S$20 billion and S$28 billion per annum2. While Tiong Seng expects to benefit from the uptick in demand, the Group will also continue to focus on cushioning the impact of three industry-wide challenges – a shortage of skilled manpower, stagnant productivity growth, and rising costs – by being a forerunner in the use of construction technologies. Commenting on the outlook for the construction sector, Mr Pek Lian Guan (白連源), CEO of Tiong Seng Holdings Limited said, "Our track record includes a wide spectrum of projects, ranging from public and private housing to civil engineering projects. As such, we believe that our extensive experience in construction puts us in good stead for the increased demand in housing and infrastructure going forward. In line with the Government's call for productivity, we will also continue to adopt innovative construction methods that enable us to cushion the impact of industry-wide challenges such as manpower shortages and rising costs." During the year, Tiong Seng demonstrated its leadership in the use of construction technologies. The Group opened its flagship "Tiong Seng Prefab Hub", the first and only automated pre-cast plant in Singapore which enables the Group to reduce reliance on labour while expecting to double production output and trimming storage costs. In addition, the Group also collaborated with RIB Software AGA in the use of its iTWO Enterprise software, which integrates 4D and 5D perspectives to the existing Building Information Modeling ("BIM"). Upon completion in three years' time, Tiong Seng will be the first company in Singapore across the enterprise level to have the full suite of RIB's iTWO Enterprise software that extends throughout the entire construction project life cycle from pre-tendering to project management. Apart from driving productivity, the Group advocated the use of environmentally-friendly construction methods and will continue to do so. Its proprietary cutting-edge concrete slab technology, Cobiax, reduces the volume of concrete used in slabs by as much as 30% and has increasingly gained acceptance within the construction sector. Property Development in the PRC Going forward, property sales and prices in second and third tier markets are expected to grow at a moderate pace, driven by urbanisation in the PRC. Forecasts show that every new urban resident brings in at least 100,000 yuan in investment, with real estate and construction-related sectors poised to benefit4. While there are concerns that new cooling measures may be introduced to prevent property prices from soaring further, analysts expect policies to remain unchanged if the increase in property prices is matched with a growth in gross domestic product5. In particular, the housing policies in second- and third-tier cities could be relaxed slightly in a bid to allow the market to absorb unsold inventory. Mr Pek concluded, "We continue to favour the growth prospects of PRC's property market as genuine buyer sentiment remains strong. Our strategy to expand our presence in the second and third tier cities will benefit from the increasing urbanization of China. We believe that this positive development will open doors for property development opportunities in the Bohai Economic Rim, especially the Tianjin Binhai New Area. The Group will continue to focus on the sales and development of its multi-phased projects in the PRC while looking out for opportunities to acquire suitable land sites. We are optimistic that property development will serve as our second engine of growth over the mid-to-long term, supplementing our mainstay construction business." 1 Population White Paper, National Population and Talent Division, Jan 2013

About Tiong Seng Holdings Tiong Seng is principally engaged in building construction and civil engineering in Singapore, and property development in the PRC. With an established track record of over 50 years, Tiong Seng is one of the leading building construction and civil engineering contractors in Singapore. It holds the highest grading of A1 from the Building Construction Authority of Singapore (BCA) for both general building and civil engineering, which qualifies the Group to undertake public sector construction projects with unlimited contract value. Tiong Seng's property development business focuses on developing residential and commercial projects in various second- and third-tier cities in the PRC. The Group has successfully developed properties in Tianjin, Suzhou and Yangzhou and it currently has four on-going projects in the Bohai Economic Rim, which is one of the main economic zones in the PRC. |