11 Nov 2011 Tiong Seng Records S$6.8 Million Net Profit On S$127.3 Million Revenue For 3Q2011 • S$296 million in construction contracts secured to date this year, underscoring strong

demand

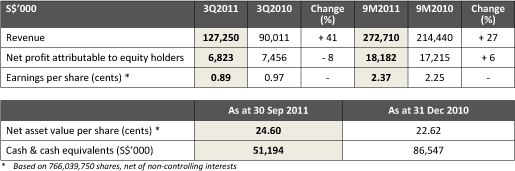

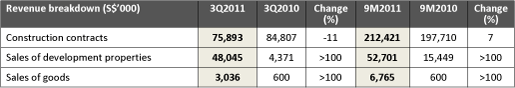

Mainboard-listed construction group and property developer, Tiong Seng Holdings Limited (長成控股) ("Tiong Seng", together with its subsidiaries, "the Group"), today reported net profit attributable to equity holders of S$6.8 million for the third quarter ended 30 September 2011 ("3Q2011"). Group revenue jumped 41% to S$127.3 million during the quarter, up from S$90.0 million in the same period a year ago ("3Q2010") as a result of significantly higher revenue from its sales of development properties and sales of goods segments. Both segments contributed strongly to the topline growth, with revenue from sales of development properties increasing tenfold to S$48.0 million from S$4.4 million, and revenue from sales of goods up from S$0.6 million to S$3.0 million respectively. This was offset by a decline in revenue from construction contracts by 11% to S$75.9 million due to a decrease in work done for completed and almost completed projects both in Singapore and Papua New Guinea ("PNG"). On a nine-month basis ("9M2011"), all three business segments enjoyed higher revenue, which lifted the Group's total revenue to S$272.7 million, representing a 27% increase from S$214.4 million recorded a year ago. Correspondingly, net profit attributable to equity holders grew 6% to S$18.2 million in 9M2011. Segmental review

For 9M2011, the increase in revenue from construction contracts was mainly due to an aggregate of S$148.4 million generated from more work done for new and on-going projects, such as The Wharf Residences, Volari, Hotel at Upper Pickering Street, Hundred Trees, Treehouse and NUS Staff Housing at Kent Vale, offset against an aggregate of S$131.8 million for less work for completed and almost completed projects in PNG and Singapore, namely Tribeca, Sky @ Eleven, Wilkie Studio, Hilltops and Shelford Suites. The Group's sales of development properties in China more than doubled its sales to S$52.7 million in 9M2011, due to the sale of 440 units of Phase 1 of the City Residence project (沧州阳光国际) in Cangzhou totaling 51,915 sqm, and the sale of 9 units of Tianmen Jinwan Building in Tianjin totaling 2,154 sqm, compared to 39 units of Tianmen Jinwan Building sold in 9M2010 totaling 7,022 sqm. As at 30 September 2011, 80 remaining units totaling 2,149 sqm of Phase 1 of the City Residence project (沧州阳光国际) and 9 units totaling 1,569 sqm of the Tianmen Jinwan Building are fully sold, but revenue has yet to be recognized as those units have not been handed over to the buyers. Revenue for the sales of goods segment rose to S$6.8 million in 9M2011, largely due to the Cobiax Technologies AG business acquired in August 2010 which contributed its maiden income with effect from 3Q2010 onwards. As at 30 September 2011, Tiong Seng holds a stable financial position with cash and cash equivalents of approximately S$51.2 million. Based on 766,039,750 shares net of non-controlling interests, the Group achieved earnings per share ("EPS") of 0.89 Singapore cents for 3Q2011. Net Asset Value ("NAV") per share (excluding Treasury Shares) as at 30 September 2011 was 24.60 Singapore cents. Continued strong demand in Singapore, PNG and PRC In accordance with the Group's revenue recognition policy, work done amounting to approximately S$20.2 million from newly commenced projects in Singapore and PNG have yet to be recognised as revenue in 3Q2011. In 9M2011, Tiong Seng added $296 million worth of construction projects to its strong order book. These projects include the 150-unit freehold luxury condominium The Glyndebourne, as well as work for the first phase of the Housing Development Board's ("HDB") eco-town development in Punggol totalling 1,072 units of Waterway Terraces I. In October 2011, the Group secured another residential project, inking its second contract from the HDB worth S$147 million for the construction of 804 units of Waterway Terraces II in Punggol West in October 2011. In the PRC, Tiong Seng has completed the construction and sales of Phase 1, out of 4 Phases, of the City Residence project (沧州阳光国际) in Cangzhou. The other phases are currently in construction while sales of phase 2 have commenced in 2Q2011. The Group is currently also carrying out the construction of Phase 1, for the Equinox project (艾维诺森林) in Dagang, and sales are expected to commence in 4Q2011. In August 2011, the Group successfully bid to develop a residential site in Suzhou New District Xu Shu Guan Development Zone (浒墅关开发区), PRC at a cost of RMB382 million. This is expected to yield about 880 high-end residential units when completed. Looking Ahead Commenting on the outlook for the construction sector, Mr Lian Guan (白連源), CEO of Tiong Seng Holdings Limited said, "Moving forward, we'll continue to observe a tough operating environment as a result of higher construction and material costs, reduction in the number of foreign workers, higher foreign workers' levies and competition from large foreign contractors. However, we are well prepared to meet these challenges head-on. Our investments in technology such as our up-and-coming Prefab Hub facility will enable us to reduce labour and increase cost efficiencies. In addition, Cobiax not only raises our edge in green construction but also elevates overall efficiency through savings in concrete used in reinforcement concrete slabs." Property Development in the PRC Added Mr Pek, "Despite the ongoing measures in China, we believe that the demand for quality housing will continue to be driven by urbanisation. We'll continue focus on the sales and development of our niche projects in China, and at the same time, look for more opportunities to build our land bank." China's current urbanization rate still lags behind the 85% achieved in developed countries3. It has been estimated that urbanization rate is expected to increase by 1 percentage point every year for the next 20 years, rising from 47% in 2011 to 57% in 2020, and to approximately 70% by the end of 20304. 1 "Promising outlook for construction sector demand in 2011", Building and Construction Authority, 12 Jan 2011

About Tiong Seng Holdings With an established track record of over 50 years, Tiong Seng is one of the leading building construction and civil engineering contractors in Singapore. It holds the highest grading of A1 from the Building Construction Authority of Singapore (BCA) for both general building and civil engineering, which qualifies the Group to undertake public sector construction projects with unlimited contract value. Tiong Seng's property development business focuses on developing residential and commercial projects in various second- and third-tier cities in the PRC. The Group has successfully developed properties in Tianjin, Suzhou and Yangzhou and it currently has four on-going projects in the Bohai Economic Rim, which is one of the main economic zones in the PRC. DBS Bank Ltd. ("DBS") was the Issue Manager, Underwriter and Placement Agent for Tiong Seng's listing on the SGX-ST. DBS assumes no responsibility for the contents of this announcement. |