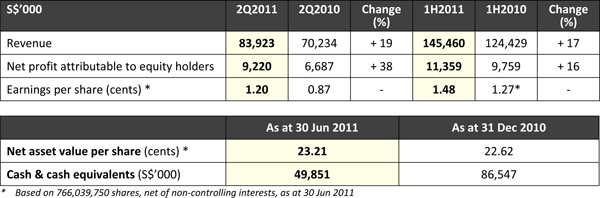

12 Aug 2011 Tiong Seng's 2Q2011 Net Profit Jumps 38% to S$9.2M New construction contracts secured in 1H2011 totaling S$296 million

Mainboard‐listed construction group and property developer, Tiong Seng Holdings Limited (長成控股) ("Tiong Seng", together with its subsidiaries, "the Group"), today reported a 38% rise in net profit attributable to equity holders of S$9.2 million for the second quarter ended 30 June 2011 ("2Q2011"). Buoyed by higher revenue from construction contracts and sales of Cobiax products, the Group's revenue rose 19% to S$83.9 million for the quarter. This was offset by revenue from development properties which decreased by approximately S$6.4 million. This brings Tiong Seng's total revenue for the first half of 2011 ("1H2011") to S$145.5 million, an improvement of 17% compared to the same period last year ("1H2010"). Accordingly, the Group's net profit attributable to equity holders in 1H2011 was 16% higher year‐on‐year at S$11.4 million, mainly due to an increase in profit from operating activities.

Segmental Review

Revenue for construction contracts in 1H2011 increased by an aggregate of S$117.4 million, largely due to more work done for new and on‐going projects such as The Wharf Residences, Volari, Hotel at Upper Pickering Street, Hundred Trees, Treehouse and NUS Staff Housing at Kent Vale. On the other hand, less work for completed and almost completed projects in Papua New Guinea and Singapore, being Tribeca, Sky @ Eleven, Wilkie Studio, Hilltops and Shelford Suites, resulted in revenue being offset by S$90.7 million. For the Group's sales of property development business in China, revenue in 1H2011 was contributed mainly from the sale of 4 units of Tianmen Jinwan Building in Tianjin compared to 15 units totaling 2,178 sqm in 1H2010. As at 30 June 2011, 12 remaining units totaling 1,983 sqm are fully sold but revenue is not recognised as those units have yet to be handed over to the buyers. In the sales of goods segment, revenue was largely from the Cobiax Technologies AG business acquired in August 2010, which contributed approximately S$2.0 million and S$3.7 million to the Group's topline in 2Q and 1H2011 respectively. As at 30 June 2011, Tiong Seng holds a stable financial position with strong cash and cash equivalents of approximately S$49.9 million. The Group achieved earnings per share of 1.20 Singapore cents (based on the share capital of 766,039,750 shares and net of non‐controlling interests) and net asset value per share of 23.21 Singapore cents.

Solid pipeline, new construction contracts and latest developments in PRC Armed with a solid pipeline of existing projects, Tiong Seng's order book for construction and civil engineering projects based on secured contracts stands at approximately S$1.1 billion at the half‐year mark, of which majority of these are expected to be fulfilled over the next 12 to 30 months. In accordance with the Group's revenue recognition policy, work done amounting to approximately S$1.7 million from a newly commenced project in Papua New Guinea has yet to be recognised as revenue in 1H2011. The Group also secured new construction contracts in 1H2011, including a contract from the Housing and Development Board to build 1,072 units in Punggol West's "Waterway Terraces" project, as well as Millennium & Copthorne Hotels plc's "The Glyndebourne" – an exclusive 150‐unit freehold luxury condominium located off Dunearn Road in the prime District 11 marketed by City Developments Limited. In addition, with its recent successful bid for a 85,510 sqm residential site in Suzhou New District Xu Shu Guan Development Zone (浒墅关开发区) in PRC, the Group will develop its third project there later this year on a high‐end property development project that is expected to yield about 880 residential units. As at 30 June 2011, Tiong Seng has substantially completed the construction and sales of Phase 1 out of 4 Phases of the City Residence project (沧州阳光国际) in Cangzhou. The sold units in Phase 1 are expected to be handed over in 3Q2011. Phase 2 is currently under construction and sales have commenced in 2Q2011. The Group is currently also carrying out construction for Phase 1 for the Equinox project (艾维诺森林) in Dagang, and sales are expected to commence in 4Q 2011.

Looking Ahead Construction Moving forward, construction costs are expected to face further upward pressure due to increased infrastructural works, healthy demand from the private sector, and continued strong building demand from HDB. Coupled with the reduction in the number of foreign workers, higher material costs and foreign workers' levies, as well as strong market competition from large foreign contractors, the operating landscape is expected to pose greater challenges. As such, the Group will continue its push towards improving productivity and efficiency by focusing on pre‐cast construction, automation, and training to improve productivity. At the same time, Tiong Seng will utilise the government's new initiative for higher tax allowances for such productivity investments wherever possible. Mr Pek Lian Guan (白連源), CEO of Tiong Seng Holdings Limited said, "Our investments in technology such as pre‐casting and advanced formwork systems have allowed us to reduce labour and yet increase cost efficiencies in the face of tough competition in recent times. Cobiax's unique concrete technology will also contribute to our overall efficiency through savings in concrete used in reinforcement concrete slabs. This year, we expect to complete the construction of our Prefabrication Hub in 4Q2011, which will generate automated pre‐cast building components for better productivity." Property Development in the PRC "In the short term, we can expect tighter credit controls and further government curbs in the smaller PRC cities, but we hold a long term view that urbanization will continue to drive demand for quality housing in China. Meanwhile, we will continue to monitor policy changes closely and focus on the sales and development of our China projects. We will also look for more opportunities to build our development land bank where possible," explained Mr Pek. China's current urbanization rate still lags behind the 85% achieved in developed countries3. It has been estimated that urbanization rate is expected to increase by 1 percentage point every year for the next 20 years, rising from 47% in 2011 to 57% in 2020, and to approximately 70 percent by the end of 20304.

1Building and Construction Authority: Promising outlook for construction sector demand in 2011, 12 Jan 2011 |