10 May 2011 Tiong Seng Records 1QFY2011 Net Profit of S$2.1 Million

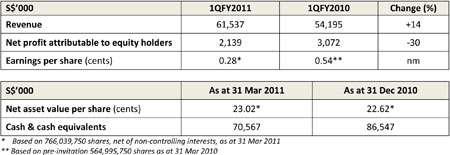

Mainboard‐listed construction group and property developer, Tiong Seng Holdings Limited (長成控股) ("Tiong Seng", together with its subsidiaries, "the Group"), today reported a net profit attributable to equity holders of S$2.1 million on revenue of S$61.5 million for the first quarter ended 31 March 2011 ("1QFY2011"). Group revenue was up by 14%, largely due to the increase in construction contract revenue and direct sales and licensing revenue by approximately S$7.0 million and S$1.7 million respectively, offset by a decline in revenue from development properties of approximately S$1.6 million. An increase in work done for new and on‐going projects such as Wharf, Volari, Hotel at Upper Pickering Street and NUS Staff Housing at Kent Vale helped to boost revenue from construction contracts by 14% year‐on‐year to S$56.0 million in 1QFY2011. However, it was offset by less work done for projects in Papua New Guinea and completed and almost completed projects in Singapore – Tribeca, Sky @ Eleven, Wilkie Studio, Hilltops and Shelford Suites, totaling S$38.5 million as compared to corresponding period last year. Revenue from its property development business in China dipped 31% to S$3.6 million as the Group recorded the sale of only 4 units from its Tianmen Jinwan Building in Tianjin totaling 1,165 sqm in 1Q2011 as contrast to 15 units totaling 2,178 sqm for the corresponding period. As at 31 March 2011, remaining 14 units totaling 2,553 sqm are fully sold but not recognized as revenue as those units have yet to meet the revenue recognition policy. Revenue from the direct sales and licensing segment, arising from the acquisition of a majority stake in Cobiax Technologies AG in August 2010, contributed approximately S$1.7 million to the Group's topline in 1QFY2011. In accordance with the Group's revenue recognition policy, work done amounting to approximately S$21.8 million from newly commenced projects, Hundred Trees and Tree House have yet to be recognised as revenue as at 31 March 2011. The Group's financial position as at 31 March 2011 remains healthy, with a strong cash and cash equivalents of approximately S$70.6 million. For 1QFY2011, the Group achieved earnings per share of 0.28 Singapore cents (based on the share capital of 766,039,750 shares and net of non‐ controlling interests) and net asset value per share of 23.02 Singapore cents (as at 31 March 2011). Strong Project Pipeline and Commanding Order Book Looking Ahead To cushion the impact, the Group will continue to explore investments in automation, training and other measures to improve productivity, and at the same time, utilise the government's new initiative for higher tax allowances for such productivity investments. Said Mr Pek Lian Guan (白連源), CEO of Tiong Seng Holdings Limited, "Going forward, we are making a strong push towards improving productivity and efficiency to meet the challenges ahead. Our investments in pre‐casting and advanced formwork systems will reduce our reliance on labour and increase our cost efficiencies." "With the upcoming completion of our Prefabrication Hub in 3Q2011, coupled with the automated production of pre‐cast building components, we will be able to push for even higher productivity. Our investment in Cobiax's unique concrete technology is also expected to contribute to our overall efficiency through savings in concrete used in reinforcement concrete slabs." Property Development in the PRC "The PRC government will still continue to develop its second‐ and third‐tier cities. The price trends for residential and commercial units in these cities will likely remain at least stable in the near term. We believe that this will hold true particularly in Tianjin, as the Tianjin Binhai New Area ("TBNA") is slated to be a new driving force in the PRC economy," concluded Mr Pek. As at 31 March 2011, Tiong Seng has substantially completed the construction and sales for Phase 1 of the Sunny International project, a 4‐phase development project in Cangzhou. Sold units are expected to be handed over to owners starting 3Q 2011. Currently, this project is in Phase 2 and it is under construction and sales are expected to commence by 2Q2011. In addition, the Group is currently carrying out construction for Phase 1 of the Equinox project in Dagang. Sales for Phase 1 of this project is expected to commence in 4Q2011.

1Building and Construction Authority: Promising outlook for construction sector demand in 2011, 12 Jan 2011 |